Financial Institutions and Triple Net Lease Lending

FIN3

The Financial Institutions and Triple Net Lease Lending division of Citizens National Bank (CNB) exists to support the growth and balance sheet management initiatives of CNB and our partners through strategic loan opportunities originated outside of our primary market or in excess of our internal hold limits.

Financial Institutions (FI)

Through the purchase and sale of loan participations and multi-bank syndicated credit facilities, our Financial Institutions team focuses on the cultivation of mutually beneficial relationships with reputable financial institutions fostering a credit culture in line with the conservative values held by CNB.

As a purchaser of loan participations, CNB seeks out high quality credit opportunities originated and serviced by well-regarded and well-managed financial institutions. These originations supplement CNB’s loan growth objectives and aid in the geographic and industry diversification of our loan portfolio. Targeted industries include commercial real estate, equipment finance and asset-based lending.

As a seller of loan participations, CNB is able to assist our financial institution partners achieve their loan growth and portfolio diversification goals by originating and participating quality loan requests from our clients and trusted referral sources, while effectively managing our loan concentrations and internal hold limits. Our FI team works alongside our Loan Servicing department to ensure a superior loan servicing experience for our clients and downstream lending partners.

As an arranger of syndicated credits, CNB is able to expand our ability to accommodate financing requests exceeding our internal hold limit by structuring and originating multi-bank credit facilities. We lean on an extensive network of banking relationships and can take a loan through a full syndication lifecycle.

Triple Net Lease (N3)

– Acquisition Financing

o Up to 75% Loan-to-Value/Loan-To-Cost

o Loan terms up to 10 years, subject to term of property lease

o Monthly payments based on a 20 – 25 year amortization schedule

– Construction Financing

o Up to 75% Loan-to-Value/Loan-To-Cost

o Loan terms up to 36 months, with a maximum interest-only period of 24 months

o Build-to-suit lease or similar tenant commitment to occupy the property upon completion of construction project is required

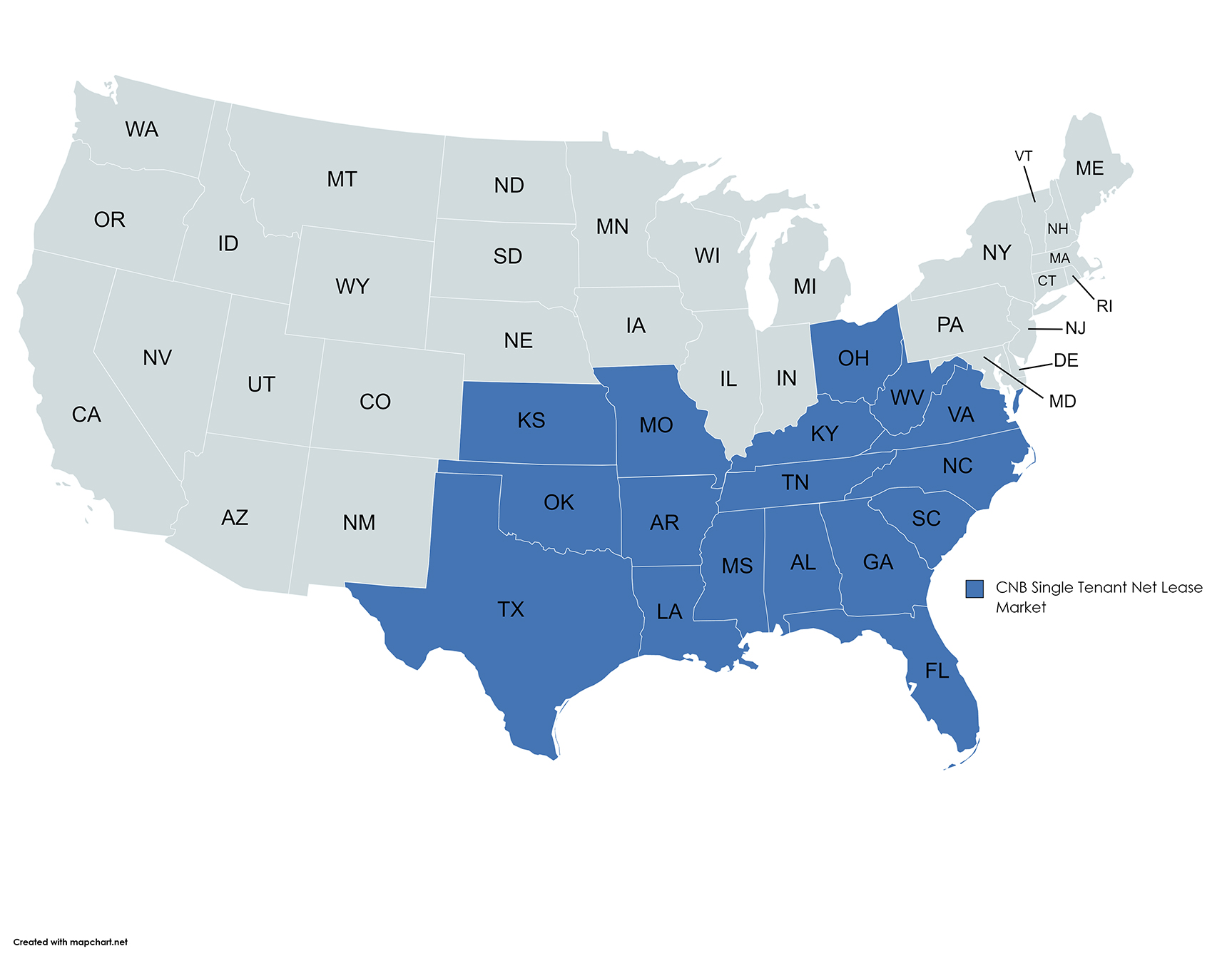

CNB Single Tenant Net Lease Market

Financial Institution (FI)

STACY J. DART

SENIOR VICE PRESIDENT BUSINESS BANKING

Triple Net Lease (N3)

MARISSA BATES

VICE PRESIDENT - BUSINESS BANKER

MARY CLAWSON

BANKING OFFICER - PORTFOLIO MANAGER